Formulas

That Help You Evaluate Your Investments

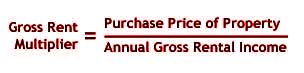

Gross rent multiplier (GRM)

provides a means of comparing properties recently sold with subject. It

represents the current supply/demand interplay in the market for income

properties of the same type as subject.

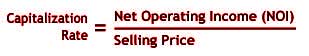

Cap rate is really a

comparable yields method on analyzing investment potential. When one is

investing in real property, one is taking the position that the rate of

return will be greater and the benefits of ownership will out weigh a

"safe" investment. When funds are put into an apartment house,

liquidity is lost and management responsibility has been accepted.

There is always an element of risk. Usually, the investor expects to

see management skills improve the rate of return, and that real estate

will appreciate at a rate in excess of the general rate of inflation.

The investor is in a position to control the risk factor.

Leverage of capital is another benefit of

investing in real estate. An investor can receive 100% of the benefits

of ownership with an up front investment of a fraction of the purchase

price. Traditionally, the downpayment for an investment property has

been 30%-40% of the purchase price.

Today, you may be able

to purchase investment real estate with 20%, 10% or even 5% down. (Of

course, the lower your down payment, the lower your monthly cash-flow.

Your personal financial strength and credit ratings will greatly affect

the loan programs you will be offered.)

Here is an example of

why real estate may be your best possible investment: If you purchase

an apartment building for $1,000,000, make a 30% down payment, keep it

for three years and it goes up in value 30% in those three years, your

return on your investment is not 30%. YOUR RETURN IS 100%!

Of course, this

example is rounded for clarity and there are costs associated with

buying and selling. Some years real estate goes up in value much more

than 10% and some years it does not increase in value at all. In rare

instances, real estate temporarily goes down in value. Real estate is a

long-term investment.

Real estate is not a

GET-RICH-QUICK

SCHEME.

Real

estate is a

GET-RICH-SLOWLY

PLAN.

Mortgage lenders use this, as

the ratio can be interpreted to mean that the cash available for the

debt service is a percentage of the amount necessary to cover the total

mortgage payments. A bank may take a position that in order to make a

loan, the cash available to pay the bank debt is 160% of the amount

necessary to cover the total mortgage payments.

or

or

Call

Michael Cornell today

(206) 527-1202

|

Commercial Brokers Association

|

|